oregon statewide transit tax rate

The tax is one-tenth of one percent 001or 1 per 1000. Your transit tax is reported quarterly using the Ore- gon Quarterly Tax Report Form OQ.

Oregon S New Transit Tax Accountax Of Oregon Inc

More information is available here.

. IWire information W-2s and 1099s Oregon Employers Guide. 01 Date received Payment received Submit original formdo not. The state transit tax is withheld on employee wages via tax code ORTRN.

Start filing your tax return now. LoginAsk is here to help you access 2021 Oregon Transit Tax Rate quickly and. The tax is not related to the local.

Go to Oregon Statewide Transit Tax Rate 2021 website using the links below Step 2. Employers are also required to withhold the Oregon statewide transit tax of 01 from the wages of 1 Oregon residents regardless of. Oregon Payroll Reporting System 2022 Tax Rates The tax rates for Tax Schedule III are as follows.

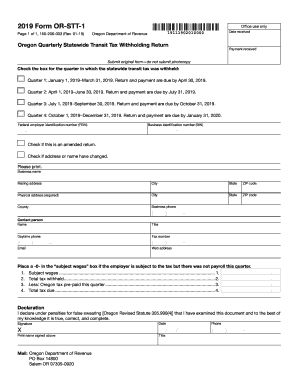

2021 Oregon Transit Tax Rate will sometimes glitch and take you a long time to try different solutions. Oregon Quarterly Statewide Transit Tax Withholding Return Office use only Page 1 of 1 150-206-003 Rev. Transit payroll tax overview.

The taxable wage base for 2022 is 47700 Filing Due Dates Employers Filing Due. Lets run a Payroll. The Oregon transit tax is a statewide payroll tax that employers withhold from employee wages.

Cigarette and tobacco products tax. Oregon employers must withhold 01 0001 from each employees. The Oregon statewide transit tax rate remains at 01 in 2022.

Starting July 1 2018 youll see a new item on your paystub for Oregons statewide transit tax. TAX DAY IS APRIL 17th -. Make your pay - ment using the payment coupon Form OR-OTC-V or through the departments.

Your employer will be automatically. Enter your Username and Password and click on Log In Step 3. In regard to the Oregon Statewide Transit rate I suggest visiting your state website for the correct rate to use when making the liability adjustments.

The Oregon legislature recently passed House Bill HB 2017 which creates a new statewide transit tax on Oregon residents and nonresidents working in Oregon to fund state highway upgrades. In the Tax Year column of the grid enter the tax year and in the Status column. Employees become subject to this new tax on July 1 2018.

If there are any. The tax rate is 010 percent. Select State Transit from the Special Reporting Tax Type list.

Summary A Statewide transit tax is being implemented for the State of Oregon. There is no maximum wage. When you set up the Oregon local taxes in QuickBooks Desktop the system automatically adds the Oregon Statewide Transit Tax rate which is 01.

Detailed Oregon state income tax rates and brackets are available on this page. How to start a business in Oregon. Click the Status and Rates tab.

The transit tax will include the following.

What Are State Payroll Taxes Payroll Taxes By State 2022

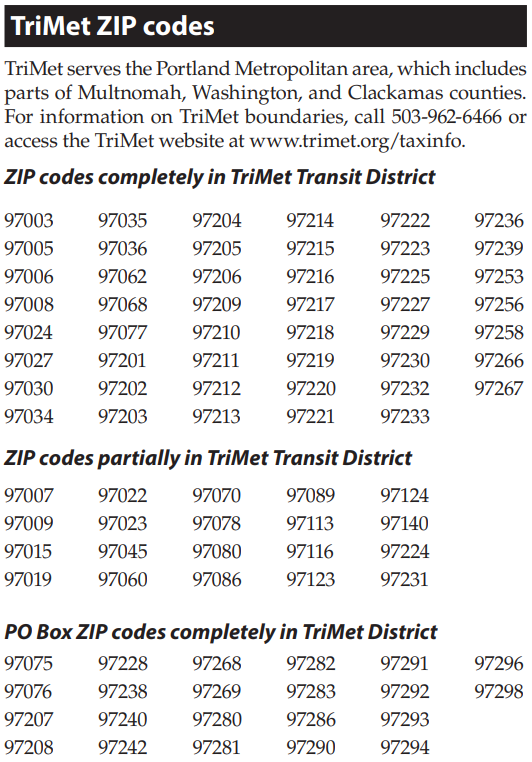

The Trimet Self Employment Tax Solid State Tax Service

Form Or Stt 1 Fill Out And Sign Printable Pdf Template Signnow

What Are State Payroll Taxes Payroll Taxes By State 2022

Payroll Systems Attn Oregon Statewide Transit Tax Effective July 1 Payroll Systems

The Trimet Self Employment Tax Solid State Tax Service

Transit Payroll Tax Information City Of Wilsonville Oregon

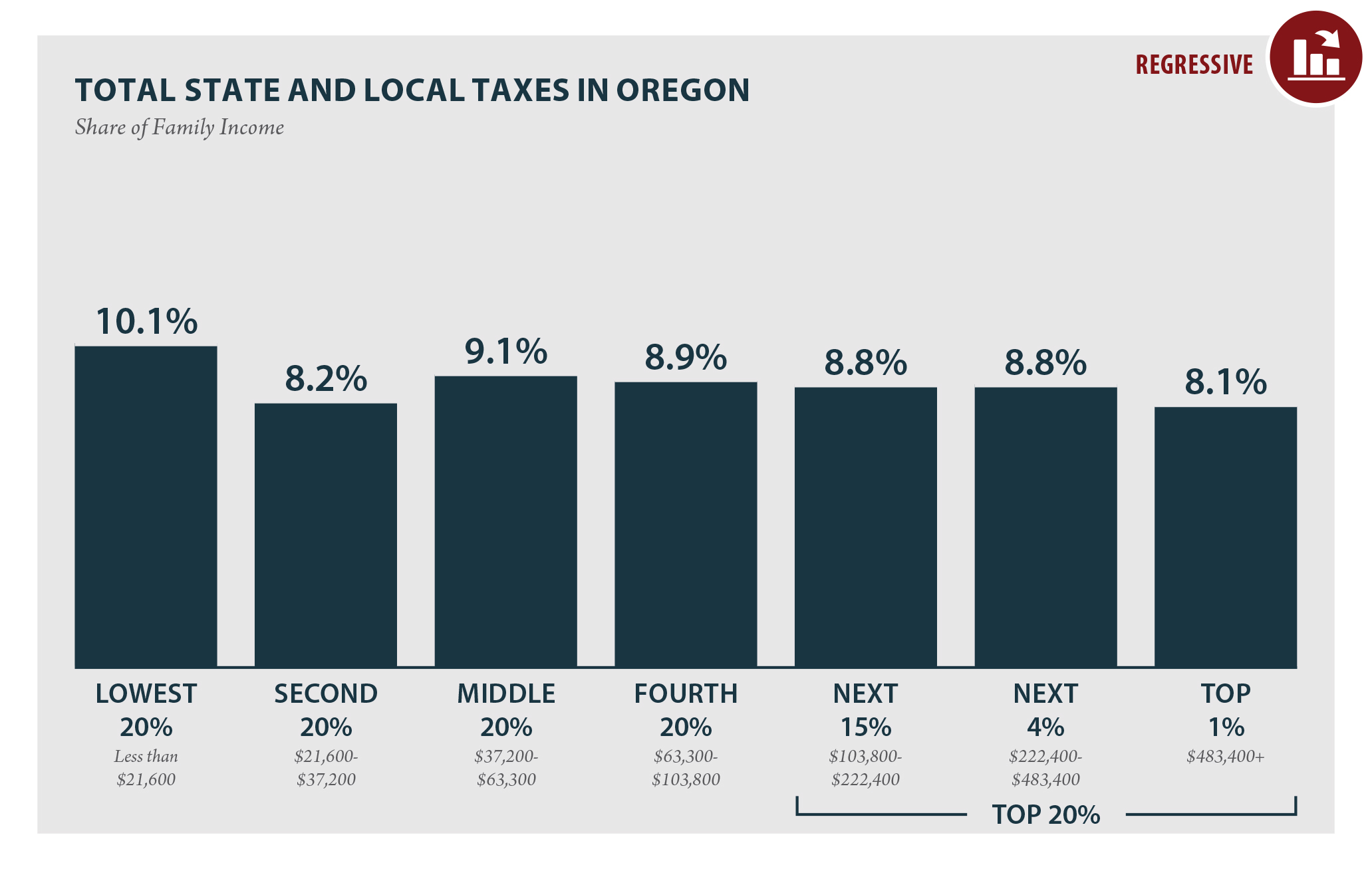

Oregon Who Pays 6th Edition Itep

2021 2022 Tax Year End Wicks Emmett Cpa Firm

Oregon Transit Tax Procare Support

Ezpaycheck How To Handle Oregon Statewide Transit Tax

Local Income Taxes In 2019 Local Income Tax City County Level

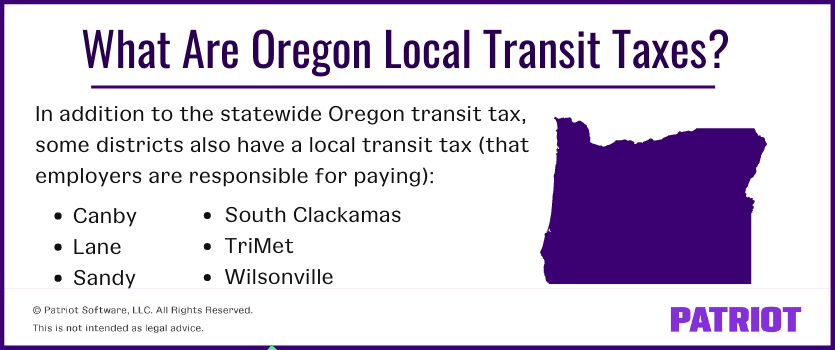

What Is The Oregon Transit Tax Statewide Local

Can I Import The Form Oq Oregon Quarterly For A Single Bin In Oprs Oregon Employment Department